Banking has been essential throughout human history, allowing individuals and businesses to manage their finances and participate in economic activities. From the grain banks of ancient Mesopotamia to the sophisticated financial networks of Renaissance Europe, the evolution of banking reflects the economic and cultural advancements of civilisation.

Yet in the ancient world, there were no direct debits, digital currencies or derivatives traders, so what was banking like thousands of years ago? How did it start, and how did it evolve? If you’re interest-ed, read on.

The Birth of Banking

The Code of Hammurabi (Credit: jsp via Getty Images)

Banking as we know it today traces its roots back to ancient Mesopotamia – modern-day Iraq, but also including parts of Iran, Turkey, Kuwait and Syria. Around 2000 BC, the temples and palaces of Mesopotamia weren’t only religious, royal, and governmental centres but also the earliest financial hubs.

These institutions stored grain and precious metals, and in the absence of coinage provided loans to farmers and traders, and kept meticulous records of transactions etched on clay tablets.

The Code of Hammurabi

The most famous of these ancient texts is the Code of Hammurabi, written in the Old Babylonian dialect of Akkadian between 1755 BC and 1750 BC. It was a comprehensive set of 282 laws that laid the foundation for early banking and financial practices as well as covering various aspects of public life. Among the elements included were:

- It established rules for entering into contracts, including for future delivery of goods. It required witnesses to set prices and dates, regulating business cycles.

- It introduced the concept of using collateral for loans, similar to modern secured loans. For example, a field of corn could be used as collateral, with the lender gaining ownership of the crops during harvest.

- The code allowed for alternative repayment plans, such as compensating lenders with harvested crops if cash was unavailable. An early form of debt restructuring.

- One of the laws provided an early example of crop insurance, allowing farmers to waive interest payments in case of crop failure due to natural disasters.

- The code emphasised accountability, reciprocity, and incentives in financial dealings, aligning the interests of service providers (like builders) with their clients.

The provisions in the Code of Hammurabi laid the groundwork for more sophisticated financial systems and banking practices that would develop in later centuries. By establishing these types of rules, the code created a framework for trust and accountability in economic transactions, which were essential elements of banking systems then, and remain so today.

Banking in Ancient Greece

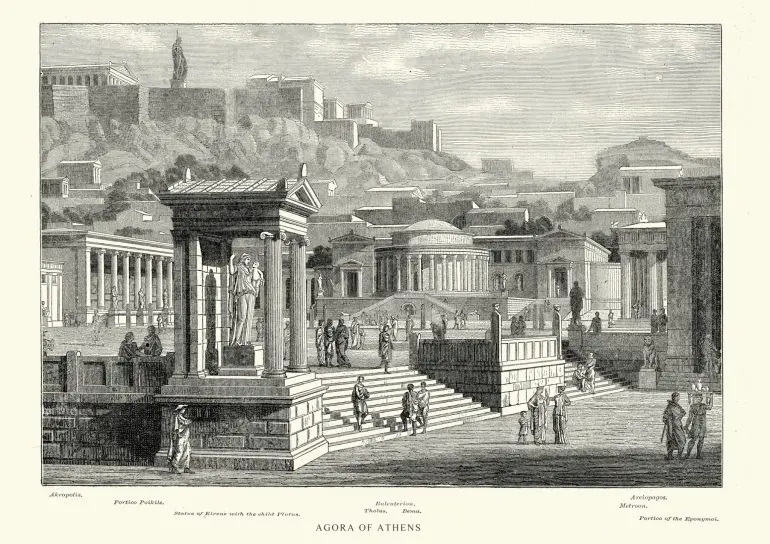

Illustration of the famous Agora of Athens (Credit: duncan1890 via Getty Images)

After the Mesopotamians, banking practices continued to develop with the ancient Greeks. Following the invention of coinage in Lydia (present-day Turkey) in the seventh or sixth centuries BC, the Greeks introduced private moneylenders and bankers known as trapezitai.

Operating in public marketplaces called agoras, they initially focused attention on testing the validity of coins, but soon expanded into deposit taking, and providing loans at interest (typically 12% per year for ordinary loans, with maritime loans carrying higher rates due to increased risk). They also opened physical banks that were owned by free citizens and staffed by trained slaves and freedmen.

These ancient Greek banks played a significant role in supporting trade across the Mediterranean by offering credit, which enabled merchants to do business over far greater distances than ever before, without the burden of carrying large amounts of cash.

The Development of Banking in the Roman Empire

A hoard of Roman coins from the reign of Trajan Decius, 249 - 251 AD (Credit: IURII BUKHTA via Getty Images)

As the Greeks built on the foundations of the Mesopotamians and Egyptians, so the Romans developed a more formalised and regulated structure for banking practices based on earlier Greek systems.

They established professional bankers known as argentarii. These bankers offered services similar to the trapezitai but operated within a more formalised and extensive economic framework due to the vast reach of the Roman Empire. These argentarii, from the Latin word argentum, meaning ‘silver’, managed deposits, provided loans, and were involved in currency exchange and money transfers. The Romans also implemented laws and regulations to govern banking activities, helping to standardise practices and protect both bankers and clients. Banking became integral to Roman commerce, supporting infrastructure projects, trade, and everyday financial transactions, similar to its function today.

As the Roman Empire came under Christian influence, restrictions were placed on bankers, including the charging of interest which was considered immoral. After the fall of Rome in the fifth century AD, banking activities in Europe largely fragmented. However, the medieval era witnessed the gradual rebirth of financial institutions.

The Renaissance

Illustration of the Knights Templar (Credit: Gwengoat via Getty Images)

By the twelfth century, banking began to re-emerge as trade revived during the High Middle Ages. Italian city-states like Venice, Pisa, Genoa, and Florence became vital commercial hubs, especially as trade across the Mediterranean, and further afield, flourished.

Before the Renaissance, merchant banking families started to establish networks across Europe. The Lombards, for example, were instrumental in offering credit and facilitating trade between different regions. The Crusades also stimulated the re-emergence of banking by increasing contact between Europe and the Middle East, which heightened the demand for financial services. Religious orders like the Knights Templar issued early forms of promissory notes that allowed pilgrims and traders to travel without carrying large sums of money.

The Medici Family

Wood engraving of Lorendo di Piero de' Medici, 1449 - 1492 (Credit: ZU_09 via Getty Images)

In the centuries that followed, banking flourished notably with the growth of influential banking families such as the Medicis in Florence. Founded in the fourteenth century, the Medici Bank became one of the most powerful financial institutions in Europe. They built upon innovative practices like double-entry bookkeeping, and letters of credit, and expanded their operations through a network of branches across the continent.

Banking during this period was closely tied to the patronage of arts and culture, with wealthy bankers sponsoring artists, architects, and scholars, fuelling the cultural achievements of the Renaissance.

The Post-Renaissance Evolution

The Bank of England in the City of London (Credit: Karl Hendon via Getty Images)

Banking continued to evolve and expand through the sixteenth, seventeenth and eighteenth centuries. The growth of international trade and the beginnings of the modern nation-state led to the establishment of more formalised banking institutions.

National banks, like the Bank of England founded in 1694, were created to manage government funds and debts. Innovations such as banknotes, checks, and the stock exchange emerged, further advancing banking practices. These developments laid the groundwork for the complex global financial systems that underpin today’s economies.

Banking on History

21st century personal banking (Credit: Oscar Wong via Getty Images)

From the grain deposits of ancient Mesopotamia and the codified laws of Hammurabi, to the financial innovations of the Greeks and Romans, and the influential banking families of the Renaissance, the evolution of banking reflects the growth and expansion of international trade and the economic advancement it drove forward.

These early systems established foundational principles of accountability and financial innovation, which continue to underpin modern banking institutions today.